ABOUT JLEN

JLEN Environmental Assets Group Limited (“JLEN” or the “Company”) is an environmental infrastructure investment fund that invests in a diversified portfolio of assets that support the drive towards decarbonisation, resource efficiency and environmental sustainability. The Company’s portfolio comprises 42 assets located across the UK and mainland Europe.

JLEN is Guernsey-registered with a premium listing on the London Stock Exchange and is a constituent of the FTSE 250 index. The Company has an award‑winning approach to Environmental, Social and Governance (“ESG”).

OUR PURPOSE

JLEN aims to invest in a diversified portfolio of environmental infrastructure that supports more environmentally friendly approaches to economic activity whilst generating a sustainable financial return. It seeks to integrate consideration of sustainability and ESG management into its activities, which help to manage risks and identify opportunities.

PERFORMANCE HIGHLIGHTS

Our results summary for the half year to 30 September 2023

NAV total return

since IPO(1)

(8.7% annualised)

FY 2023: 119.9%

Net Asset

Value

FY 2023: £814.6m

Net Asset Value

per share(1)

FY 2023: 123.1p

Portfolio

value

FY 2023: £898.5m

Dividend

cover(1,2)

(1.54x pre-EGL)(3)

FY 2023: 1.51x

Half-year dividend

per share(4)

HY 2022: 3.57p

Renewable

energy generated

HY 2022: 655GWh

GHG emissions

avoided

HY 2022: >96,500 tCO2e(4)

Tonnes of waste

diverted from landfill

HY 2022: 351,500

Wastewater

treated

HY 2022: 14.5 billion litres

UK homes powered by

renewable electricity(6)

HY 2022: 120,731

- The NAV total return, Net Asset Value per share and dividend cover are alternative performance measures (“APMs”). The APMs within the financial statements are defined on pages 61 to 63.

- On a paid basis.

- The dividend cover is calculated after payment of the first instalment of the EGL tax of £5.2 million. Comparative dividend cover also shows before payment of EGL to aid comparison

with prior year. - On a declared basis.

- Despite overall energy production increasing in 2023, the avoided emissions figure is lower for the half year 2023 than the half year 2022 – this decrease in avoided emissions is due to the change in the composition of the electricity produced.

- Excludes anaerobic digestion (“AD”) portfolio.

CHAIR’S STATEMENT

“In spite of a challenging operating environment, JLEN remains in a strong position to deliver on its operational and financial objectives.”

Ed Warner

Chair

On behalf of the Board, I’m pleased to report that JLEN delivered a resilient NAV performance for the six months ended 30 September 2023.

The period under review has continued to be marked by uncertainty. Persistent inflation and rising interest rates, both short- and long term, make it difficult to predict the point at which the peak in the rate tightening cycle might be reached. While electricity prices, key to the prospects for many of JLEN’s assets, were less volatile than in the preceding 12 months, geopolitical tensions remained a troubling backdrop against which to forecast and plan.

In spite of a challenging operating environment, JLEN remains in a strong position to deliver on its operational and financial objectives. Whilst the portfolio value was modestly up, NAV per share declined slightly, but the Company continued to pay a dividend that is well covered by returns from its diversified portfolio of environmental infrastructure assets.

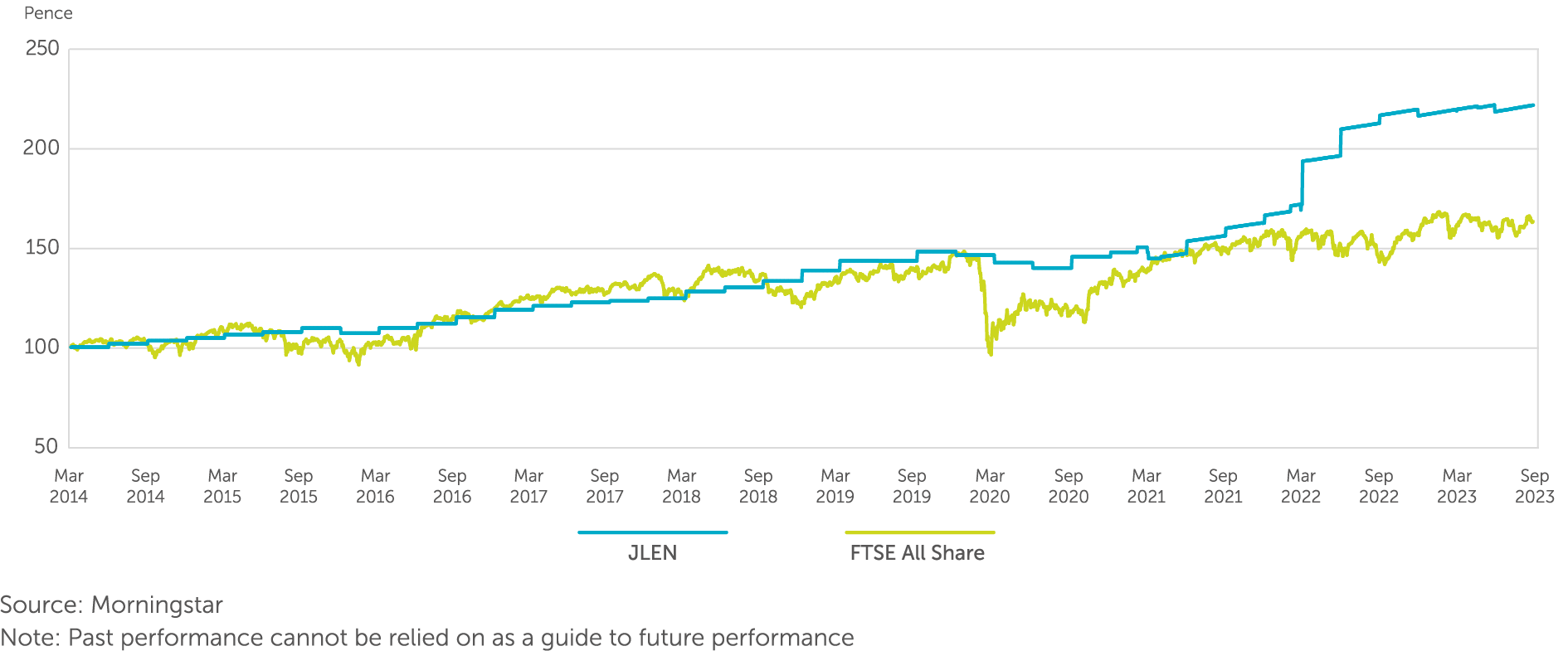

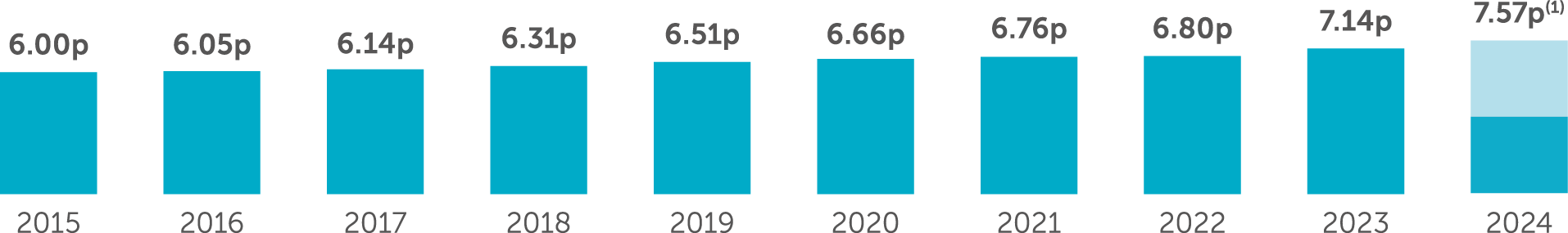

JLEN’s NAV per share declined by 2.8% in the period, from 123.1 pence to 119.7 pence. This is after the payment of two dividends to shareholders in the period totalling 3.68 pence. Dividend cover in the period was 1.32 times (1.54 times prior to paying the Electricity Generator Levy (“EGL”)). The Board is pleased to be able to reaffirm the dividend target of 7.57 pence per share for the full year.

The Board is acutely aware of the discount to NAV at which JLEN’s shares and those of its peers continue to trade in the current environment. It is very disappointing nonetheless that JLEN’s shares have dropped below their underlying asset value. In light of this derating of JLEN’s shares, the Board has worked closely with our Investment Manager, Foresight Group, to establish a clear, disciplined strategy for the allocation of capital that will ensure the continued long‑term success of the Company while reflecting the challenge and opportunity posed by the discount to NAV at which the shares trade. This capital allocation strategy includes active consideration of potential asset disposals, should attractive prices be achievable, that would free up capital for deployment in other ways to benefit shareholders.

In the current market environment, capital generated from JLEN’s portfolio and from future asset sales will likely be prioritised towards existing commitments, planned follow‑on investments and asset enhancements within our current portfolio, alongside managing the Company’s credit facility to maintain a robust balance sheet, as well as the potential for share buybacks.

The Board and the Investment Manager believe that the discount to NAV at which JLEN’s shares are currently trading materially undervalues the Company, and so represents an attractive investment opportunity. Share buybacks consequently form an important part of our capital allocation considerations.

The current discount to NAV has heightened significance because, when the Company launched, the Board committed to put forward a discontinuation vote if the Company’s shares trade at an average discount of 10% or more over the course of any financial year. The average discount at which the shares have traded in the current financial year to date has been approximately 13%. If a discontinuation vote is triggered, it will be proposed as a special resolution at the 2024 Annual General Meeting. The Board is actively monitoring the share price discount, and will be engaging with shareholders in the coming months to discuss any concerns they may have.

As JLEN approaches its tenth anniversary, the Board is encouraged by the prospects for the portfolio and proud of its track record of delivering consistent dividend growth and NAV growth over its life. The outlook for sustainable infrastructure investment remains positive as the UK and European economies decarbonise to meet net zero emissions targets and find ways to live more sustainably.

We will be suitably cautious in our approach given the prevailing uncertainties, but considering this is a long-term asset class, we view the future with confidence. Thank you to all shareholders for your continued support.

Ed Warner

Chair

24 November 2023

THE INVESTMENT MANAGER

JLEN is managed by Foresight Group LLP (“Foresight” or “Foresight Group”) as its external alternative investment fund manager (“AIFM”) with discretionary investment management authority for the Company.

Performance summary

The portfolio continues to benefit from the Company’s diversification strategy. Solid operational performance combined with elevated revenues from power sales and RPI-linked cash flows underpinned a dividend cover of 1.32 times for the first six months of the financial year, or 1.54 times before payment of the Electricity Generator Levy. The resulting cash performance of the portfolio added 0.3 pence to the NAV this period.

Anaerobic digestion (“AD”) and solar performance have been high points, with above-budget generation, while wind and energy-from-waste have detracted due to low wind resource and occasional unplanned outages respectively.

Electricity and gas prices have continued to fall back modestly over the period, although JLEN continues to benefit from the practice of having a substantial proportion of generation for both electricity and gas on fixed price arrangements, partially insulating the portfolio from price fluctuations. The portfolio is fixed 68% for winter 2023 and 50% for summer 2024. In addition to the changes in power prices, flexible generation revenues available to UK battery storage projects have also reduced. The Company has also made its first payments under the EGL.

JLEN’s construction projects progressed well during the period. West Gourdie, its first grid-scale battery storage project, started commercial operations. The controlled environment (“CE”) Glasshouse project substantially completed and started growing the first batch of plants post the period end, and conversations are underway with pharmaceutical companies interested in offtake arrangements. The CE Rjukan project is progressing well and on target to begin partial operations early in the new year.

Ongoing build‑out of construction-stage investments provide potential for capital appreciation once they become operational and continue to provide further diversification for the portfolio while balancing the overall risk profile.

Market and opportunities

The investment thesis for environmental infrastructure remains strong. The markets and opportunities remain largely unchanged from those discussed on pages 12 to 16 in the Company’s Annual Report 2023.

We continue to be very encouraged by the prospects for the Company’s green hydrogen interests in Germany through its investment in developer HH2E. Regulatory developments underpin the case for hydrogen in key markets such as transport and blending with natural gas. Discussions are ongoing with a range of offtakers and we expect a significant proportion of gas produced to be under contract at the point of financial close of the first project.

Although we continue to see opportunities across the spectrum of environmental infrastructure, further investment into new projects will be limited in light of the wider market position and the focus on capital allocation. Additional deployment will be to meet existing firm commitments for construction-stage assets and into opportunities that support or enhance the Company’s portfolio.

Risks and risk management

The Company’s approach to risk governance and its risk review process, as well as the principal risks to the achievement of the Company’s objectives, remain unchanged to those set out in the risks and risk management section on pages 38 to 48 of the Company’s Annual Report 2023.

Developments in relation to those principal risks, particularly those which could potentially have a short to medium-term impact during the period to 31 March 2024, are outlined below.

Energy prices

Energy prices have fallen back significantly from the extraordinary levels seen during 2022 and the beginning of 2023. The Company attempts to mitigate the valuation risks associated with forecasted power prices being different to the actual prices achieved by using short-term price fixes and assumptions informed by market forward prices and a blend of three different specialist forecasters where fixes are not in place. Ongoing global events, including the war in Ukraine and the developing crisis in Israel and the Gaza Strip which threatens stability in the region, continue to create volatility for oil and gas prices, with knock-on implications for wholesale markets that the Company’s assets sell into. Risks to the valuation related to power price assumptions exist both to the upside and the downside.

Regulation and tax risk

REMA

The UK Government launched a far-ranging consultation about the future of the GB electricity market (“REMA”) in 2022, intended to ensure that market arrangements promote affordability for consumers and energy security as the GB system decarbonises. In some scenarios considered in the initial consultation, the basis on which GB electricity‑generating assets and battery storage assets in the JLEN portfolio receive revenues could be profoundly changed.

The government issued initial findings in March 2023, including confirmation that some of the more radical proposals would not be taken forward following market participants’ feedback.

Nevertheless, options representing significant change are still being explored, including locational pricing and splitting the wholesale market by technology. The government has said that it will return with a further consultation during the remainder of 2023. Realistic timelines for adoption will probably see the current system remaining in place until the late 2020s. Nevertheless, the assets in the Company’s portfolio are long-term infrastructure assets and there is a risk that the current basis for valuing the assets over the long term will need to change to reflect the ultimate outcome of REMA.

Renewables Obligation consultation – Fixed Price Certificates

The UK Government launched a consultation into the practicalities of introducing Fixed Price Certificates (“FPCs”) into the Renewables Obligation regime in place of Renewable Obligation Certificates (“ROCs”) that are issued to qualifying renewables generators for electricity generated. ROCs are the primary subsidy mechanism for onshore wind and large-scale solar. While the introduction of FPCs has always been expected and should be mildly beneficial for ROC-based assets by removing some uncertainty, the consultation asks for industry views on some measures that would be detrimental to the valuation of ROC-based assets. The Investment Manager has engaged with trade bodies and other interested investors in responding to the consultation and notes consistent opposition to these measures; consequently the risk is assessed to be low.

The consultation ended in October 2023 and government has not said when it will publish its findings.

Electricity Generator Levy

The Company has made the first payments on account for tax due under the new EGL. In doing so, the Company has taken advice on the way in which the EGL should apply to its diversified portfolio of assets, including some that pay for feedstock. The legislation is new and there is a moderate risk that the calculation of tax due under the Levy is incorrect.

Inflation, interest rates and discount rates

Inflation in the UK economy has remained high over the period, giving rise to fears for “higher for longer” interest rates to drive inflation down. Higher inflation taken in isolation is helpful for valuations of JLEN assets as many of them benefit from revenue streams that are explicitly linked to the Retail Price Index (“RPI”), including ROCs, Feed-in Tariffs (“FITs”) and biomethane-producing assets under the Renewable Heat Incentive (“RHI”). However, higher interest rates have a negative effect; while the large majority of JLEN’s debt is project-level finance, fully hedged against interest rate rises, higher interest rates read across into higher discount rates for valuing infrastructure assets. Since 30 September 2022, the Directors have increased discount rates for the portfolio by an average 150 bps, leading to the current weighted average discount rate of 9.4%.

Fear of prolonged high interest rates and resulting lower asset valuations is partly responsible for the discount to NAV at which the listed renewables infrastructure sector is trading; the current share price implies a WADR of 13.4%. This is the highest implied portfolio return since IPO. It is possible that the end of the current rising rate cycle will lead to a reassessment of the appropriate discount rate for assets.

Investment outlook

While the listed renewable infrastructure sector as a whole is facing headwinds and equity markets are likely to remain closed to JLEN and its peers for some time, the fundamental growth story for the sector and for JLEN remains as strong as ever. In the current environment we are focusing our efforts on laying the foundations for future NAV growth through the Company’s construction-stage assets, currently 9% of the portfolio.

These assets provide potential for capital growth as they pass through the construction stage and become operational. We are particularly optimistic about the outlook for green hydrogen and its potential to decarbonise many carbon-intensive sectors of the economy, with some analysts predicting that the green hydrogen market will grow exponentially (by 500 times) by 2050(1) to meet net zero targets. We also remain focused on effective allocation of capital and so have paused on starting construction of the two remaining battery energy storage projects given the volatility seen in that market.

Although we see a healthy pipeline of potential investments, for now, available cash generated through the portfolio will be prioritised to meet existing capital commitments, earmarked follow-on investments and targeted enhancements, all with the aim of maintaining and increasing the value of the current portfolio. The Company has sufficient funding to meet its revolving credit facility (“RCF”) commitments and will consider asset disposals, as it has successfully done before, where attractive opportunities exist to recycle capital.

We are cautiously optimistic about the future for JLEN and the sector. We have a strong team in place and we will continue to focus on our portfolio management activities to ensure that the Company maximises returns from its existing portfolio. We have confidence in the investment case, and remain committed to continue delivering long‑term sustainable financial returns for shareholders.

All figures as at 31 March 2023 (FY23) unless otherwise stated.

- As at 30 September 2023, with £8.8bn FUM.

- £50.2 million as at 31 March 2023.

- As defined by the London Stock Exchange Green Economy Mark.

- Five-star PRI scores awarded across the Group, Private Equity and Infrastructure divisions. Issued in September 2022, see Foresight website for more details.

SUSTAINABILITY AND ESG

Environmental performance 2022/23

Social performance 2022/23

Governance performance 2022/23

- Despite overall energy production increasing in 2023, the emissions figure is lower for the half year 2023 than the half year 2022. This decrease in avoided emissions is due to the change in the composition of the electricity produced.

- Estimate based on the asset production value as this figure was not reported in H1 2022.

- In some instances, the six months of data was not available and in that case the tonnages were estimates based on the previous year’s figures.

- Excludes AD portfolio.

- Full-time equivalent (“FTE”) jobs are calculated using total hours worked over the course of the year.

- This metric was not reported on in HY 2022, as a result, the FY 2023 figure is disclosed instead.